TenX

Fees & Limits

Funding Methods

UPDATE 26 May 2021: This company seems to have closed down its card operations. On their website, they refer to a new project called Mimo. Mimo, however, does not seem to offer any form of card issuance, but is a "protocol that provides a safe way to mint and earn in a new stable token pegged to the Euro".

Accordingly, we have marked the TenX Card as an inactive project in our database.

To find an active crypto debit card that you can use today, please visit our Crypto Debit Card List to see what options there are.

TenX Review

A common argument for regular money (also known as fiat currency) as opposed to cryptocurrency is that you can’t use cryptocurrency to buy groceries and other everyday items. Well, through the use of a cryptocurrency debit card, you can. This is a review of TenX, one of the crypto debit cards out there.

General information

TenX is an cryptocurrency debit card which launched (or rather, relaunched) in January 2019. The initial launch was in July 2017.

The company behind the card today is TenX Pte Ltd (based in Singapore). There's is also a Liechtenstein company in the mix, TenX Payments Europe AG, and that company is registered by the Financial Market Authority of Liechtenstein for the issuing of electronic money.

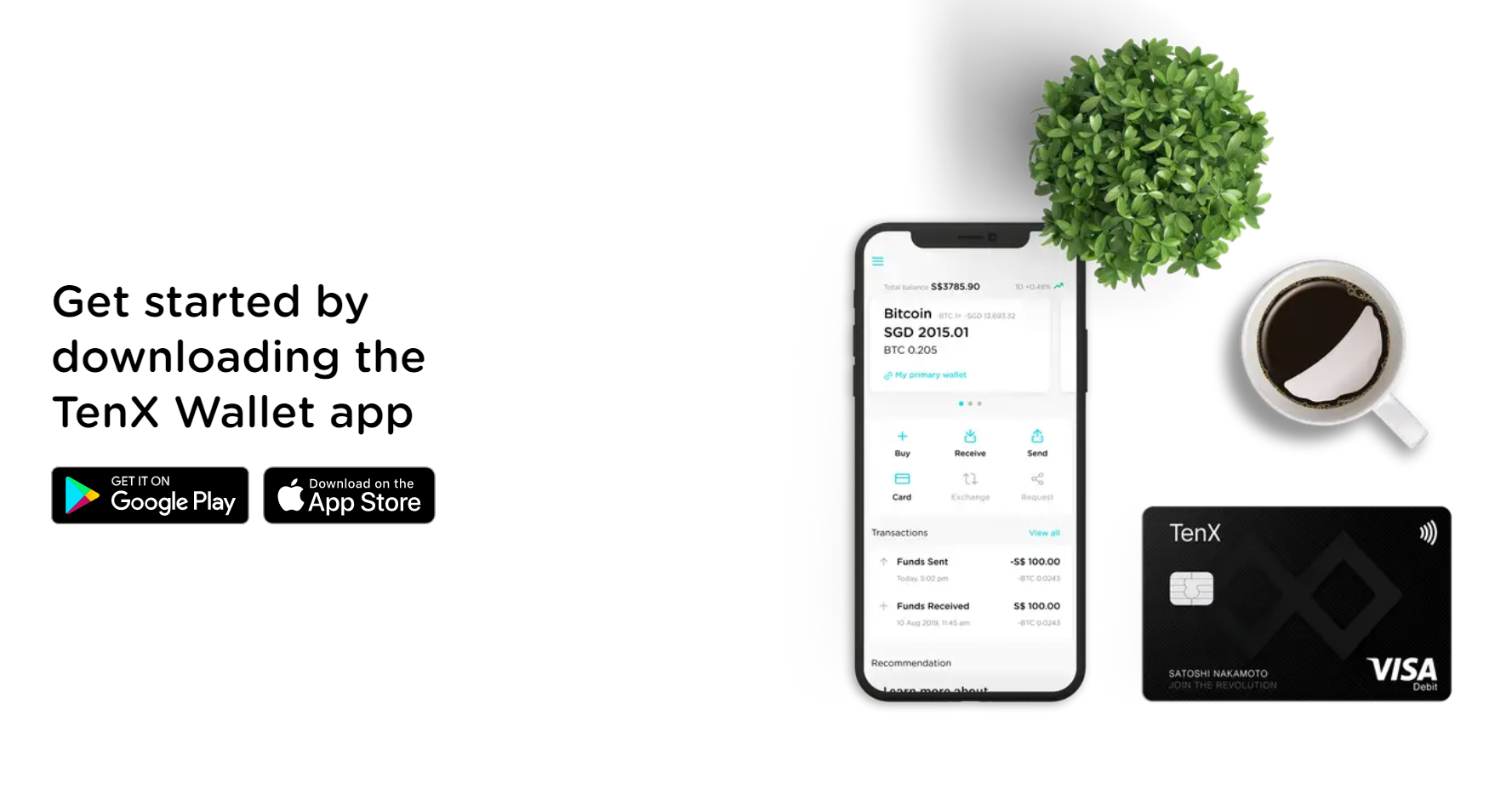

The first thing you need to do in order to acquire the card is to download the TenX Wallet app, available on both Google Play and AppStore.

You then order the card in the app and you will normally receive it within 7-9 days if you reside in any of the European countries. If you live in Asia or the Pacific, delivery might take up to 5 weeks.

As two of the main advantages with the card, TenX emphasizes its detailed transaction tracking and its 24/7 card security. The detailed transaction tracking is essentially that you can track your purchases and that there is no delay between you making a purchase, and such purchase also showing up in the app. We actually don't see this is anything but standard when it comes to payment cards, but at the same time we understand if this is something TenX are proud of. As for the security, TenX highlights that you receive real time notifications when the card is used, that you have the option of using advanced security to lock and unlock the card, and that the card uses 2FA (two factor authentication) for added security.

Buy Bitcoin

An even more interesting function in our mind is that you can buy Bitcoin with the help of the card's associated wallet, the TenX Wallet. When you have bought Bitcoin, such Bitcoin balance is immediately possible to spend with the help of your TenX Card. Very nice functionality indeed.

Supported Currencies

With the TenX card, you can spend Bitcoin (as mentioned above), but also Litecoin and Ethereum, and the card will most likely support even more cryptocurrencies in the future.

With respect to fiat currencies, TenX supports the USD and the SGD. More fiat currencies will most likely be supported going forward as well.

VISA-card

TenX is a VISA-card. This gives the card a magnificient reach. The company behind TenX says that over 54 million places in more than 200 countries currently accepts the card. This makes the card perfect for a true globetrotter.

US-investors

US-investors may not use this card. So if you’re from the US and you’re looking for a crypto debit card, please refer to our Crypto Debit Card List to find one for you.

Picture of Card

The following is a picture of the card:

TenX Fees

We think that TenX charges competitive fees. This means that the fees with this card is not a disadvantage to using it.

There is no monthly fee. The issuance fee is an ordinary USD 15.00 for the physical card and USD 1.50 for the virtual card.

There is a fixed ATM-withdrawal fee amounting to USD 3.25. The latter fixed fee might be disadvantageous in countries where the normal ATM-machines only allow smaller withdrawals (USD 20 for instance). In such scenarios, in order to withdraw a larger amount you need to withdraw several times, thus triggering the fixed fee each time.

Furthermore, the most important fee of them all, the commission on spending. TenX charges no commission based on your spending. This means that if you buy a pair of jeans for USD 100, this will only reduce your crypto assets with USD 100, and nothing more.

There is no maximum deposit which is great news for people interested in making large deposits to cryptocurrency debit cards.

Concluding remarks

If this is the cryptocurrency debit card for you, congratulations. If not, check out one of the other epic cryptocurrency debit cards in our cryptocurrency debit card list. Good luck!