Paycent Card

Fees & Limits

Funding Methods

Cryptos (13)

Paycent Card Review

A common argument for regular money (also known as fiat currency) as opposed to cryptocurrency is that you can’t use cryptocurrency to buy groceries and other everyday items. Well, through the use of a cryptocurrency debit card, you can. This is a review of Paycent Card, one of the crypto debit cards out there.

General information

According to information on its website, the company has delivered more than 94,000 cards since inception. Paycent Card supports over a dozen different cryptocurrencies, and with respect to fiat currencies, Paycent Card supports EUR, GBP and USD.

To the best of our knowledge, US-investors may also use this card.

There are three different Paycent Cards: Ruby, Sapphire and Solitaire. The main difference between the three cards is the spending limits and withdrawal limits. The spending limits for the different cards are as follows: USD 5,000 per day for Ruby, USD 5,600 per day for Sapphire and USD 13,000 per day for Solitaire. Withdrawal limits are USD 5,000 per day for Ruby, USD 1,650 per day for Sapphire and USD 10,000 per day for Solitaire.

Picture of Cards

The following picture shows how the three different cards look (Ruby at the top and Solitaire at the bottom):

Paycent Card Fees

We think that Paycent charges competitive fees. There are many fees involved with using a debit card, so we thought the easiest way to show them was to simply copy past the below table in this review. The below table shows the various fees and limits involved with using the card:

There are no monthly fees or issuance fees, which is far more consumer friendly than the vast majority of other crypto debit cards.

ATM-usage is priced at USD 4.50.

As you know, the most important fee of them all is the commission on spending. Paycent charges a fixed fee of USD 1.50 per transaction, and if you’re abroad there is a FX conversion fee of 2.50%.

The maximum annual deposit is USD 0.6 million. We doubt that you will need a higher maximum deposit limit. But if you do, please contact us and we’ll help get you sorted.

There is a minimum spend per day of USD 1.00. This is a bit weird we think, why should that even be a fee?

Paycent Card "Cashback"

The card from Paycent also offers something a little bit interesting: a "cashback" feature. The reason for putting cashback in quotation marks is that the function doesn't really give you anything back, rather it entitles you to not having to pay any FX-fees when making transactions with the card. Not having to pay certain fees is not the same as getting money back when you spend, in our opinion. This promotion was launched on 20 March 2019.

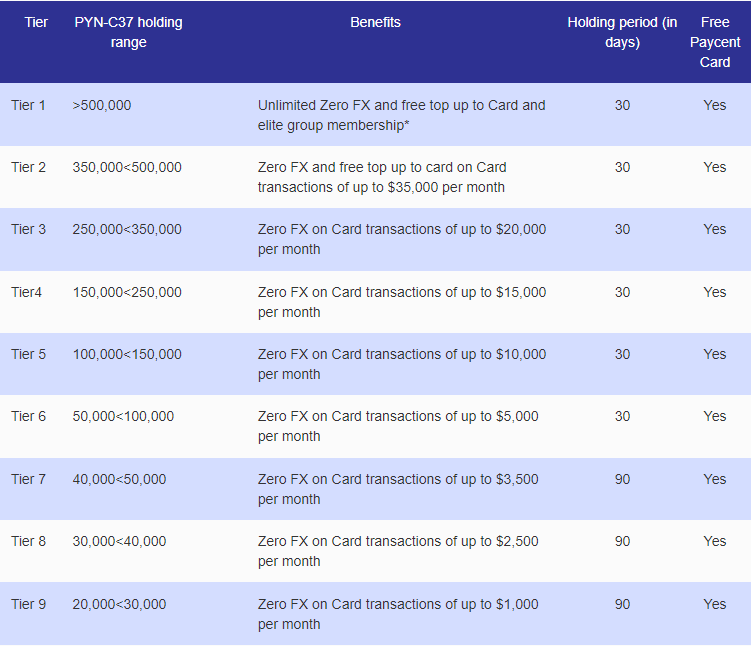

In any event, how does it work? Well, there is a 9 tier "cashback"-level, and where you are placed in these levels depend upon how many Paycent Tokens (the token issued by the Paycent company) that you hold. On the date of last updating this review (14 January 2021), you were required to hold Paycent Tokens to a value of USD 30.57 to reach the first level (tier 9). To reach the highest level (tier 1), your total holding of Paycent Tokens had to be worth around USD 765. The different levels essentially just modify how much you are allowed to spend without being charged FX-fees, the more the better. This is the table outlining the differences between levels:

Concluding remarks

Finally, if this is not the card for you, check out one of the other promising crypto debit cards in our crypto debit card list.

Good luck!