Binance

Exchange Fees

Deposit Methods

Cryptos (433)

EXCLUSIVE OFFER: If you sign up to Binance using this link, you can get up to USD 100 in sign-up bonus by completing certain tasks.

You're welcome!

Binance Review

What is Binance?

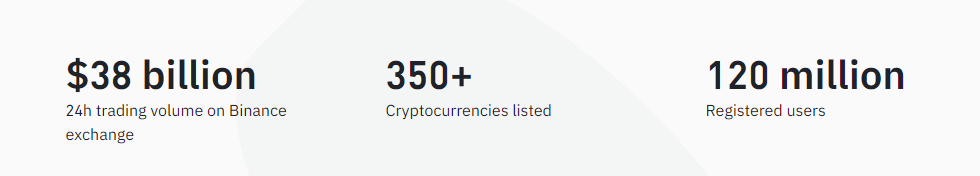

Do we really need to tell you what Binance is? It is the giant. The titan. The most powerful player in the crypto world. It dwarves all other exchanges. It has 120 million registered users.

On 25 January 2023, Binance's 24 hour spot trading volume was USD 20 billion. The silver medalist, Coinbase, had a 24 hour spot trading volume of USD 2.36 billion. Almost 90% less! There's Binance, then there's nothing, nothing, nothing, then Coinbase, then other exchanges.

As the undisputed leader in the industry, Binance also has loads of money to spend on marketing. Here, for instance, is a video Binance made with footballer Cristiano Ronaldo in connection with its launch of its NFT series called The CR7 NFT Collection:

Binance Supported Cryptocurrencies

Binance supports a very large number of cryptocurrencies, more than 350 different ones. This makes it one of the exchanges in our Cryptocurrency Exchange List with the most supported cryptocurrencies overall. The platform also has some form of quality assurance system. This system ensures that projects that have once qualified to be listed but later fail to meet such qualification requirements are delisted.

To see all of Binance's supported cryptos, please visit this page.

Binance Staking Services

Binance is also among the crypto exchanges out there that offer so called staking services. They generally call it DeFi Staking at Binance. On the date of last checking the various staking options at Binance (17 January 2023), they offered staking for 14 different crypto assets. Among these 14, the estimated APY (Annual Percentage Yield) with the staking period set to “Flexible” ranged from 0.60% (USDT) to 5.39% (AAVE).

You can start staking at their platform here.

If you’re interested in learning more about staking, the various staking types and where you can get the best staking rates, you can also have a look at our extensive Guide To Ethereum Staking.

Binance Affiliate Program

As all big exchanges do, Binance also has a referral program in place for its users. Through the referral program, existing users can refer new users and then earn a commission from the trading of the referred users. The referring user receives up to 50% of all the trading fees generated by the referred user when spot trading, and 30% when trading futures.

This means that if you (user A) refer a friend (user B), and user B starts spot trading on the platform, you will receive 50% of user B's trading fees - forever.

You can sign up to the referral program here.

Mobile Support

Naturally, the Binance platform is also available for Android and Apple mobile phones, or whatever other smart phone you might have. Sure, most traders in the crypto world today carry out their trades via desktop (around 70% or so). However, there are naturally people out there that want to do it from their smartphones as well. Binance can support you, whatever preference you might have.

Binance Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at Binance in spot trading mode, obtained on 25 January 2023:

There is also a version called the “Binance Convert”, which is the easiest of them all to understand and navigate with. The trading fee when using Binance Convert is however 2.00%, which might be worth keeping in mind. The below is the Binance Convert userface (very easy and intuitive):

Futures Trading

On 17 September 2019, Binance officially launched their futures trading. Futures are also known as Option contracts. An option contract is a contract that gives the holder of the option a right – but not an obligation (thus an “option”) – to buy (call option) or sell (put option) a certain asset at a certain price. Certain options give you the right to exercise the option whenever (before expiry of the contract), and other options are only permitted to exercise during a specific date. The former is known as American Options, and the latter is known as European Options.

You can trade four different types of futures here: USD-M Futures, COIN-M Futures, Binance Leveraged Tokens and Binance Options. The USD-M Futures consist of Perpetual or Quarterly Contracts settled in USDT or BUSD. COIN-M Futures are Perpetual or Quarterly Contracts but settled in crypto. The Binance Leveraged Tokens are what you would like when you trade with leverage without any risk of liquidation. And, finally, the Binance Options – these are what Binance themselves call the “crypto options made simple”.

Sign up on this link to save 10% of your trading fees on your futures trading forever.

Binance OTC Trading Portal

Binance also has an OTC-desk. With an OTC Trading Portal (OTC is acronym for Over The Counter), you can execute larger trades without any risk of “slippage”, which is what we call price movements due to large transactions.

The minimum trade size for the OTC Trading Portal is an equivalent value of 200,000 USDT, and 25 different coins and tokens will initially be available for trading. Users simply need to have a KYC verified (level 2) account on Binance.com to begin trading.

Binance Fees

The fees at any exchange are very important to consider. Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. We call makers “makers” because their orders make the liquidity in a market. Takers are the ones who remove this liquidity by matching makers’ orders with their own. The maker-taker model encourages market liquidity as the makers providing the liquidity often receives a fee discount compared to the takers.

There are also a number of top crypto exchanges that don’t charge different fees between takers and makers. Usually, we call such exchanges’ trading fees “flat”.

Binance Trading Fees (Spot Trading)

Binance offers a flat trading fee of 0.10%.

Accordingly, Binance does not care about whether you are a taker or a maker. For investors who prefer to pick up existing orders from the order book, this might be an attractive trading fee model. Binance’s trading fees are far below the industry average which, according to the most extensive industry report on trading fees, was 0.2294% for takers and 0.1854% for makers during the second quarter of 2022.

The trading fees are also reduced based on trading volume and holdings of Binance’s native token, the BNB, as set out in the below table (retrieved from Binance’s website on 25 January 2023):

Finally, we must also mention here that Binance offers zero-fee bitcoin trading for certain trading pairs. This offer has been in place since 6 July 2022 and is valid "until further notice". Such further notice has not yet been given on the date of last updating this review (28 February 2023). The zero-fee BTC-trading pairs are: BTC/AUD, BTC/BIDR, BTC/BRL, BTC/BUSD, BTC/EUR, BTC/GBP, BTC/RUB, BTC/TRY, BTC/TUSD, BTC/UAH, BTC/USDC, BTC/USDP and BTC/USDT.

Binance Withdrawal fees

Withdrawal fees are usually fixed and vary from crypto to crypto. If you withdraw BTC, you pay a small amount of BTC for the withdrawal. If you withdraw ETH, you pay ETH.

Binance charges 0.0002 BTC per BTC-withdrawal, which is below the global industry average (being 0.0004599 BTC per BTC-withdrawal according to this report) and a quite competitive fee. 0.0002 BTC is if you withdraw on the regular Bitcoin blockchain. You could lower your withdrawal fees even further if you would just use the BEP20 chain (withdrawal fee then 0.000004 BTC per BTC-withdrawal) or the BEP2 chain (withdrawal fee then 0.0000067 BTC per BTC-withdrawal).

Deposit Methods and US-investors

US-investors

Binance - that this review covers - does not allow US-investors on its platform. However, in November 2020, Binance created a separate entity called Binance.us which does allow US-investors. So if you're from the US and looking for a place to trade, check out Binance.us.

Deposit Methods

This exchange offers a very wide range of deposit methods in order to open its door to anyone who wants to enter. This makes it a so-called “entry-level exchange”.

Good work, Binance!

FAQs

Are Binance's fees high?

The fees charged by Binance are lower than the industry average and very competitive. For spot trading, Binance charges 0.10% per order from both the takers and the makers. For contract trading, Binance charges 0.05% from the takers and 0.01% from the makers.

What is the minimum deposit on Binance?

Binance has no minimum deposit requirement at all.

How long is the withdrawal time at Binance?

In our experience, withdrawals at Binance take on average 2 minutes for USDT (on the TRC20-network) and 6 minutes for ETH.

Has Binance ever been hacked?

Binance has actually been hacked a number of times, but to our knowledge, none of these hacks have ever affected resulted in a loss for any individual user. Accordingly, yes, they have been hacked, but no user has ever lost any assets.

Is Binance secure?

While Binance has been hacked a number of times historically, we still think that it is correct to say that Binance, from a user perspective, is secure, considering that no user has ever lost any assets due to these hacks.

Where is Binance based?

Binance is registered in the Cayman Islands, but has dozens of offices around the world, including in Bahrain, Dubai and Paris.

Which countries are restricted from using Binance?

Users from the following countries may NOT use the Binance platform: USA, Malaysia, Ontario (Canada), and any other country subject to Sanctions, like; North Korea, Cuba, Iran, Syria, Venezuela and Russia.