Bibox

Комиссии биржи

Методы внесения депозита

Поддерживаемые криптовалюты (134)

Bibox Review

What is Bibox?

Bibox is a so called “decentralized exchange”. Decentralized exchanges are becoming increasingly more popular. They are definitely gaining market shares against their centralized counterparts. Bibox has been up and running since 2017.

General Information on DEXs

Decentralized exchanges do not require a third party to store your funds. Rather, you are always directly in control of your coins. Furthermore, you conduct transactions directly with whoever wants to buy or sell your coins.

Decentralized exchanges normally does not require you to give out personal information either, which makes it possible to create an account and right away be able to start trading. The servers of decentralized exchanges are normally spread out which leads to a lower risk of server downtime. However, decentralized exchanges as opposed to regular top crypto exchanges normally have an order book with lower liquidity than the regular top crypto exchanges.

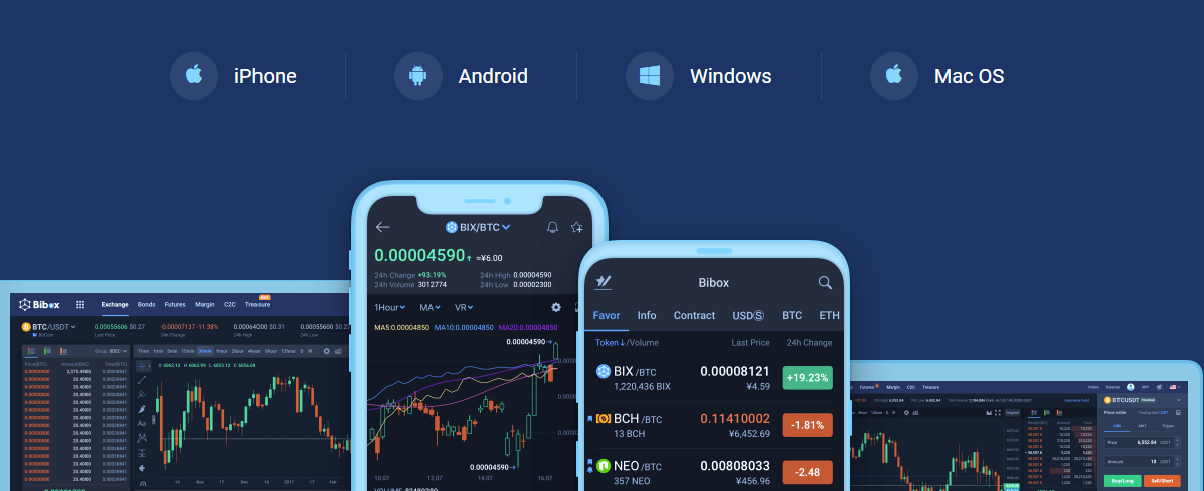

Mobile Support

As many other exchanges, Bibox also offers support for mobile phones (IOS and Android). This means that you are not restricted from trading at Bibox just because you are not at home at your desktop. While most people do trade from their desktop, there are naturally also others who prefer to do it from mobile devices.

Bibox Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at Bibox:

Bibox Fees

Bibox Trading fees

Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. Makers are so named because their orders make the liquidity in a market. Takers are the ones who remove this liquidity by matching makers’ orders with their own.

Bibox trading fee for takers is 0.20%. Makers enjoy a discount on the trading fee and they trade with a trading fee of 0.10%. These fees are quite in line with the industry averages which has historically been 0.25% but is now creeping towards 0.10%-0.15%.

Furthermore, if you trade with the exchange’s own token (the BIX token), you get a 25% discount on the trading fees. This means that the trading fees for such trades will only be 0.15% for takers and 0.075% for makers if trading with BIX.

Bibox Withdrawal fees

This trading platform charges a withdrawal fee amounting to the network fee. At the date of this review, the network fee for BTC is around 0.000051 BTC. This fee is below the industry average and thus constitutes a strong competitive advantage against the majority of other top crypto exchanges in the market.

Deposit Methods

The exchange does not accept any other deposit method than cryptocurrencies, so new crypto investors are actually restricted from trading at Bibox. If you are a new crypto investor and you wish to start trading at Bibox, you will have to purchase cryptos from another exchange first and then deposit them at Bibox.

Bibox Security

The servers of decentralized exchanges are normally spread out. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime and also means that decentralized exchanges are virtually immune to attacks. This is because if you take out one of the servers, it makes little to no difference for the network of servers in its entirety. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a decentralized exchange, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, however, you normally hold assets at that exchange until you withdraw them to your private wallet. A centralized exchange can therefore be hacked and your funds held at such exchange can be stolen. That is not possible when it comes to a DEX.